A very brief history of responsible investing

Welcome to the 256 new techies who have joined us since last Friday. If you haven’t already, subscribe and join our community in receiving weekly tech insights, updates, and interviews with industry experts straight to your inbox.

This week we’re quoting Isaac Applbaum (Founder and Partner at MizMaa Ventures)

What Applbaum said:

“I use my social and ethical yardstick when I work with my companies. It is critical that the companies I work with serve some sort of societal benefit.”

He was speaking on the subject of investments

Applbaum is known for weaving together investments and philanthropy – and the ability to engage in philanthropic work is something he values highly.

“I believe that if you just work for the money you will never be fulfilled,” he added. “And so I have spent my life trying to figure out how to combine both activities successfully.”

While he doesn’t identify himself as an impact investor or focus his investments on a singular social cause, a quick look at his firm’s portfolio confirms his interest in startups that bring a benefit to people and communities.

Responsible investing: how did it start?

Chatting to Applbaum got us thinking about responsible investing in general. How did it start – and how much of an impact does it have around the world?

In basic terms, responsible investing means that an investor considers social, environmental, and governance issues when they’re making investment decisions. Profitability is always a critical consideration for any investor – but a responsible strategy includes positive social change as a key priority too.

And responsible investing strategies have surged in popularity over the last decade. For example, research by the London Stock Exchange Group subsidiary FTSE Russell found that

84% of asset owners worldwide in 2021 said they were implementing or considering sustainable investment strategies – up from 53% in 2018.

It’s generally believed that responsible investing has its roots in religion and moral principles, and that its growth has been fuelled by the rise in social activism from the 1960s onwards.

Investors began to acknowledge that their funds have an impact…

…and that their investment decisions can influence whether that impact has a net positive (or a net negative) effect on the world.

In 1971, the world’s first sustainable mutual fund was launched. Called the Pax World Fund, it was created by Methodist ministers in the US. They didn’t want church funds to be invested in companies involved in the Vietnam war. And that fund is still active today.

As of 1994 there were 26 sustainable funds with USD $1.9 billion worth of assets under management.

And today, there are well over 10,000 ESG funds worldwide.

These funds don’t tell us how many individual investors and venture capital firms are choosing to invest with a focus on social change, even if (like Applbaum) they don’t explicitly call themselves impact investors. But they do show us that responsible investing has grown immensely – and it can be both profitable and positive.

Does responsible investing have a real impact?

In short: yes.

We know that investors play a critical role in driving social change, transitioning to a greener future, and developing technology that enables human beings to live better, healthier, and more collaborative lives.

Where investors choose to put their money does matter.

In Applbaum’s words:

“I strongly believe that building products/companies with a benefit to society will both help the company be successful, and also fulfill our responsibility to society.”

Read our full interview with Isaac Applbaum here.

Have an idea for a topic you'd like us to cover? We're eager to hear it! Drop us a message and share your thoughts.

Catch you next week,

Richard McKeon

Group Marketing Director

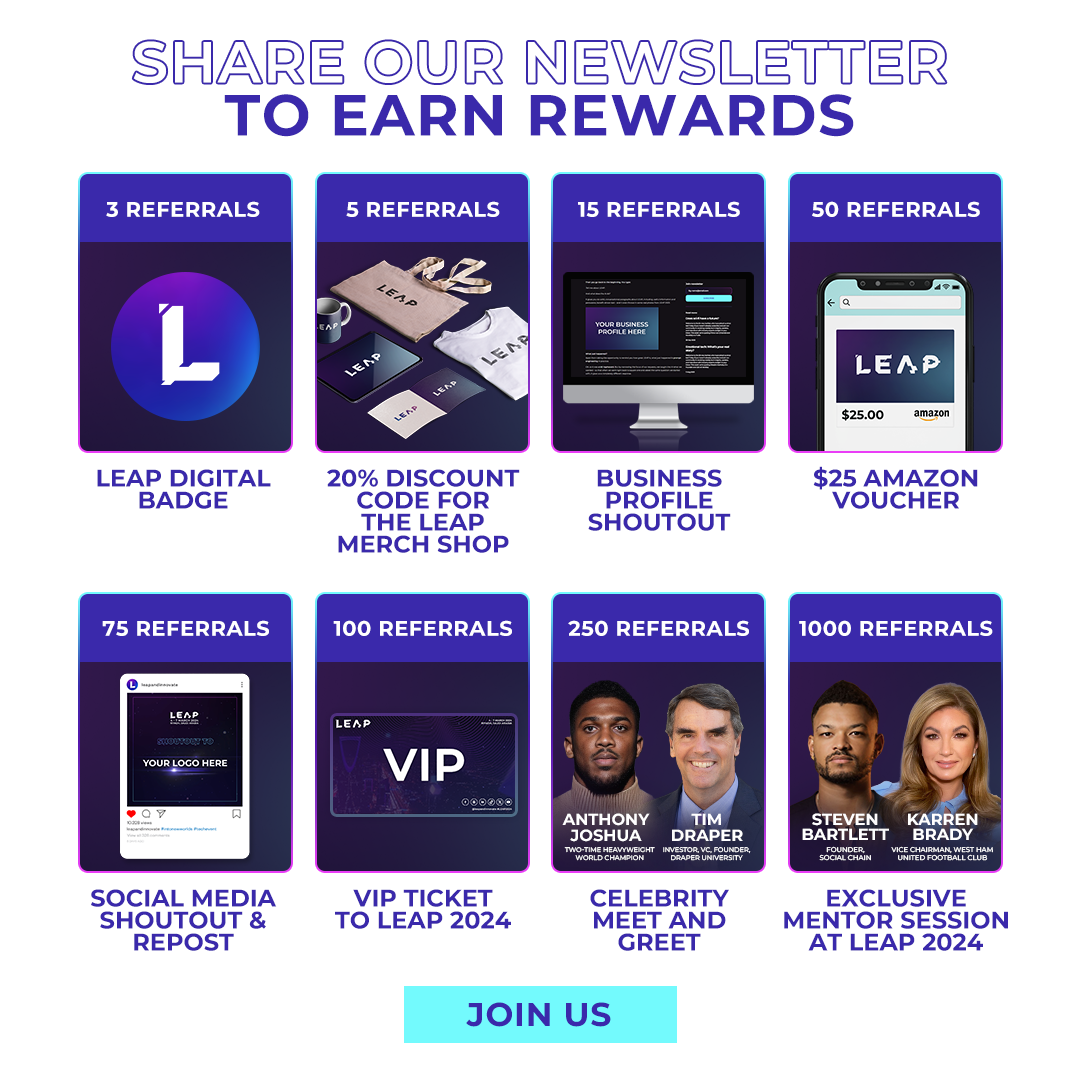

P.S. - Mark your calendars for LEAP 2024 📅 4-7 March 2024. Want to be a part of the action?